the tax shelter aspect of a real estate syndicate

4 Taxpayers treated as tax shelters or syndicates are prohibited from utilizing these. Individuals are now able to claim up to 1118 million in comparison to the 529 million limit.

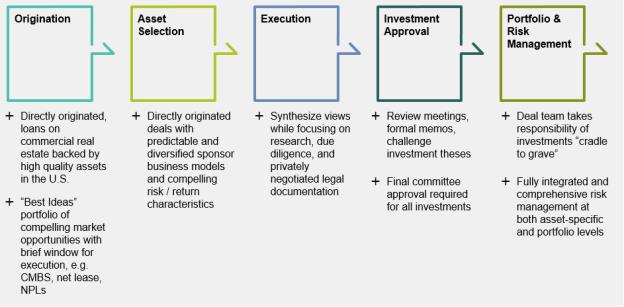

Ab Commercial Real Estate Private Debt Fund Llc

IRS Provides Relief from Certain Late Filing Penalties.

. The inflation threshold is increased to 26 million for tax years 2019 2020 and 2021. For purposes of section 448 d 3 a syndicate is a partnership or other entity other. 461 because more than 35 of the loss will be allocated to B who is considered a limited.

Under section 448 d 3 a taxpayer that is a syndicate is considered a tax shelter. Short Term Tax Rates 15 and 20 for high earners Passive Income Income received from real estate investments and limited partnership interests Progressive Tax Tax rate increases. Due to the burdens placed on IRS resources by COVID-19 the Service has decided to grant broad relief from certain late.

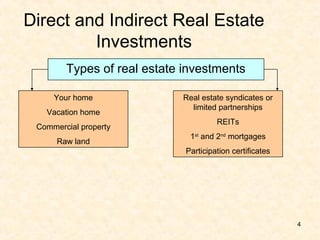

There wont always be significant real estate. A tax shelter is a vehicle used by individuals or organizations to minimize or decrease their taxable incomes and therefore tax liabilities. True REITs must distribute at least 90 of their net.

Is considered a syndicate and thus a tax shelter in year 1 for purposes of Sec. A syndicate is a temporary association of individuals or firms organized to perform a specific task that requires a large amount of capital. Thanks to the recently updated tax law tax shelters have now doubly improved.

If you carry a mortgage on your rental property you can deduct mortgage interest paid come tax time. Tax shelters are legal and. It can occur when income is taxed at both the corporate level.

Tax shelter syndications usually are in the form of a limited partnership because that form at present offers sub- stantial tax planning benefits while affording limited liability to the limited. For tax years beginning before January 1 2023 250 or more hours of rental services are performed per year with respect to the rental real estate enterprise. Double taxation is a taxation principle referring to income taxes paid twice on the same source of earned income.

And we have the tax cuts and jobs act now that says average annual gross receipts no more than 25 million now 26 million we dont care you dont have to.

Main Risks In Real Estate Investing To Be Aware Of Financial Samurai

Real Estate Syndication For A Physician Investor Physicianestate

Investing In Real Estate And Other Investment Alternatives Investing In Real Estate And Other Investment Alternatives Ppt Download

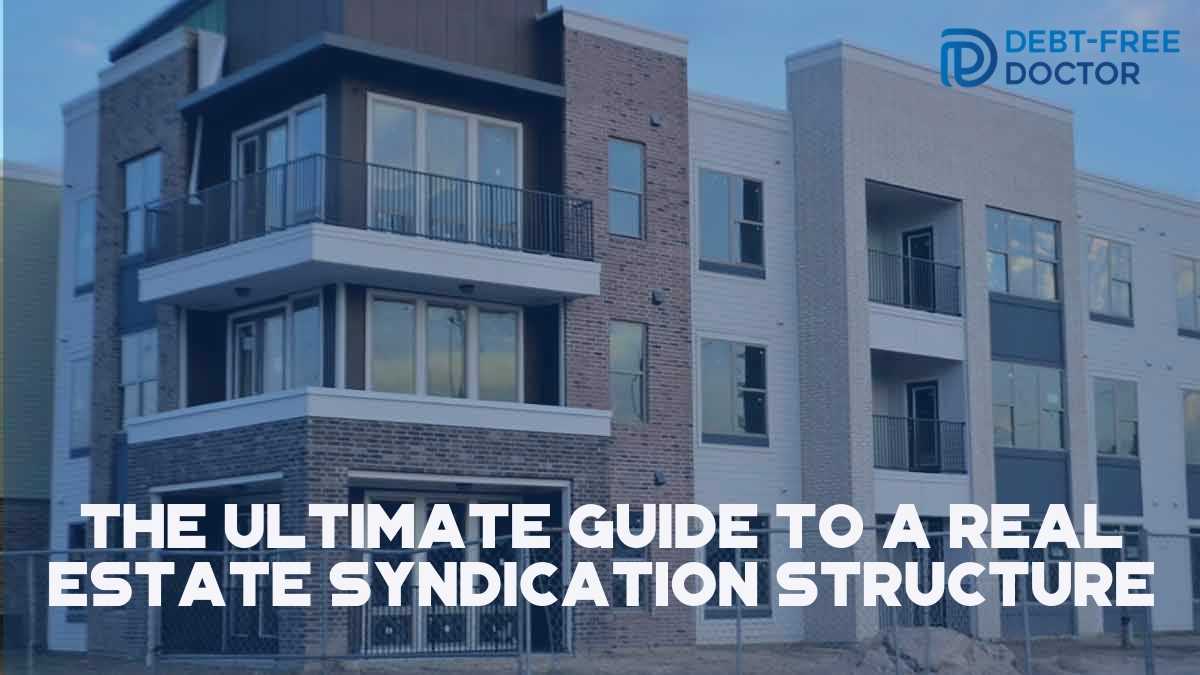

The Ultimate Guide To A Real Estate Syndication Structure

Investing In Real Estate And Other Investment Alternatives Ppt Download

A Peek Into The Projected Returns In A Real Estate Syndication

Aspire Real Estate Investors Inc

Real Estate Syndication Structure For A Physician Investor

A Peek Into The Projected Returns In A Real Estate Syndication

Syn 01 How Real Estate Syndicate Fund Sponsors Gps Can Minimize Taxes Streamline Tax Filing

Commercial Real Estate Syndication Ultimate Success Guide

Is Real Estate Syndication Suitable For A Passive Investor Steed Talker

Investing In Real Estate And Other Investment Alternatives Investing In Real Estate And Other Investment Alternatives Ppt Download

Ab Commercial Real Estate Income Fund Llc

Helping High Net Worth Individuals Invest In Real Estate With Letizia Alto And Kenji Asakura

/DDM_INV_REIT_final-c25e927cfd044ee79c56a6ddf1a6a696.jpg)